In business, standing still is moving backward. As a business leader, it is your job to keep your company moving in a forward direction, which often means finding new and exciting opportunities for growth. Regardless of what your business does, it falls into one of three categories: service, merchandise, or manufacturing. The following will help you plan for your business’s growth – and help you identify the best funding options to bring those plans to life.

Merchandisers

Sometimes misidentified as retailers, merchandisers actually constitute a much larger group of businesses better described as resellers. Merchandising businesses buy products at wholesale prices and resell them, unchanged, at retail prices. Grocery stores, convenience stores, and distributors are common merchandisers.

Growth Strategies

Merchandisers can grow in nearly any direction, but two strategies offer the easiest progress:

- Open additional locations. Buyers are more likely to stop into a store if it is conveniently located, so additional locations will dramatically increase a business’s consumer base.

- Expand online. Alternatively, if a merchandiser lacks the resources to grow physically, businesses can now find new audiences digitally. Already, most merchandisers have at least basic websites to direct customers to their stores; adding a webstore to an existing site isn’t difficult thanks to a bevy of online selling tools.

Funding Options

Cash flow is often tight in reselling businesses, so funding for growth might be difficult to come by. These options are ideal for merchandising businesses looking to grow:

- Inventory financing. This type of loan allows lenders to fund the purchase of inventory, freeing up cash for other endeavors, like growth.

- Supplier financing. Businesses with good supplier relations might ask their suppliers for more flexible terms, like longer payment periods or the ability to pay with credit, so they can use more cash for expansion.

- Cash advances. If the growth period is certain to be short and explosive, businesses can request advances on credit and debit sales from their merchant services providers.

Service Providers

Schools, banks, professional firms with lawyers and accountants, most businesses within the hospitality industry, and a great many B2Bs all count as service providers. These businesses do not sell physical products; rather, they make money by offering skills, advice, and expertise at a price.

Growth Strategies

Unlike merchandisers, service providers are relatively restricted in the ways they can expand. Depending on their services, many are restricted from expanding to new locations or moving online. Still, there are some widely available options for growth:

- Diversify. Service providers can sell new services or add products to their offerings. For example, a school might offer adult education classes at night, or an IT support firm might begin selling useful software.

- Merge. To gain access to more of the market, service providers should consider acquiring or merging with other businesses. Ideally, the merger will add new expertise as well as access to a new market.

Funding Options

Service providers might not have inventories to leverage for funding, but they do have other resources to use when looking for money to grow:

- Factoring. Invoice factoring, also called accounts receivables financing, allows businesses to sell their unpaid invoices for fast cash. Usually, this improves cash flow so businesses can reinvest sooner and increase growth.

- A/R loans. Vastly different from A/R financing, A/R loans allow businesses to use their accounts receivables as collateral.

- VCs and investors. Not all service providers will offer the intense growth venture capitalists and investors crave, some – especially those in tech – might be able to court rich backers.

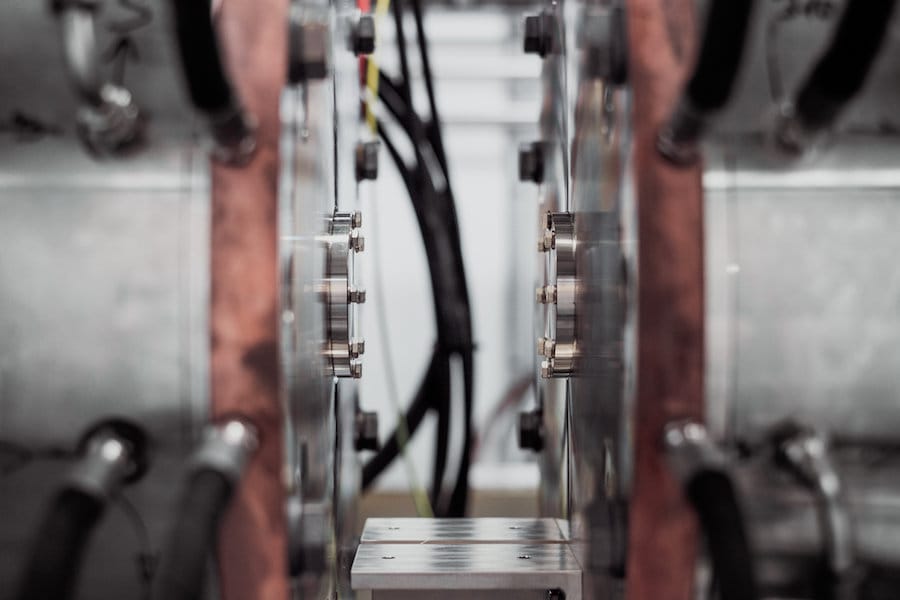

Manufacturers

Like merchandisers, manufacturers deal in physical products. Unlike merchandisers, manufacturers typically purchase products intending to use them as materials for making something new. A manufacturing business can be anyone who transforms products before making sales.

Growth Strategies

Some growth strategies that are exceptionally useful to manufacturers are to:

- Form alliances. Forming an alliance with a similar or related business is a good way to increase visibility and strengthen sales – though it may require sending some business to allies rather than keeping it to oneself.

- Win government contracts. The government is one of the best customers a manufacturer can have; it on time, it maintains relationships for years, and it buys unbelievable amounts of product.

Funding Options

While most envision manufacturers as large factory operations, manufacturers can take many sizes and shapes. Therefore, no one funding option may be sufficient at helping a manufacturer grow. Here are a few viable options:

- Crowdfunding. One of the trendiest funding methods, crowdfunding allows manufacturers to gauge public interest in potential products and raise funds from their ideal consumers.

- Lines of credit. A mix between a loan and a credit card, a line of credit allows businesses to borrow money from a recurring balance – but they only pay interest for the money they use.

- Government grants. There are government-sponsored grants for nearly any type of business. Though the application process is often long and arduous, the money has fewer strings than other financing options.

Source: InspirationFeed